The ICICI Home Loan Interest Rate 2022. ICICI Home Loan Online application and status check process at www.icicibank.com

ICICI Home Loan

Many Indian residents can fulfill their dreams to own a home with the help of ICICI bank India. The opportunities come at low-interest rates and better payment tenure of up to 30 years. ICICI bank is a famous private sector bank with various beneficial offers to all customers. The bank ensures to provide products that suit every user’s financial range. There are different types of ICICI house loans based on the user’s needs and financial ability.

ICICI Home Loan Schemes

| The ICICI bank Saral Rural Housing loan. |

| ICICI Home Loan Balance Transfer |

| Home improvement loan |

| ICICI Home loan top-up scheme |

| ICICI land loan |

| ICICI Step-up Home loan |

| ICICI Instant Home loan |

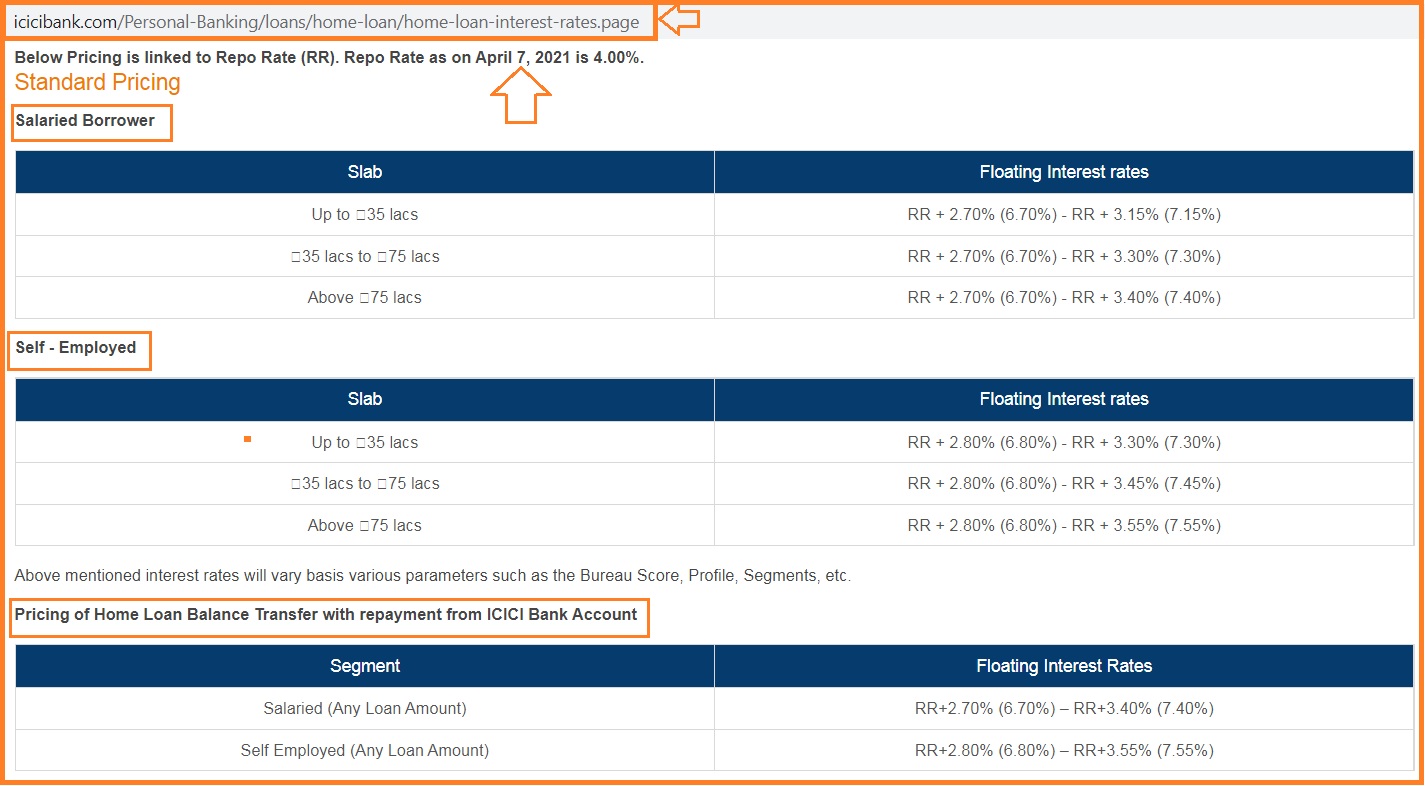

ICICI Home Loan Interest Rate

| Quarter ended on September 2021 | Minimum | Maximum | Mean |

|---|---|---|---|

| Home Loan | 6.70% | 10.55% | 7.03% |

| Non Home Loan | 6.90% | 13.15% | 8.63% |

ICICIBank Home Loan Processing Fee

0.25% to 2% of the loan amount + GST

Required Document for ICICI Home loan

Eligible ICICI bank customers should provide the following documents before the home loan application process.

- The ICICI bank home loan application form.

- Address proof documents such as utility bills, DL, PAN card, passport, and more.

- Identity proof documents: passport, Aadhaar card, PAN card, voter ID, etc.

- Property documents: any legal documents from authorized government officers or stamped agreement for sale, property tax, payment receipts, and more.

- Income certificate or proof: salary slip, tax payment documents.

- Proof of self-employment.

What are the Eligibility Criteria for an ICICI Home Loan?

The ICICI bank specifies who qualifies for the Home loan service. Besides being a resident of India and an ICICI bank customer. The customer must fulfill the following criteria:

Employed Applicants

- The applicant should be 21 years to 65 years of age.

- One should be an Indian resident

- The monthly earning must be Rs. 10,000 and above.

- One has experience or be a member of at least two years.

Self-Employed Applicants

- The applicant should be an Indian resident or NRI.

- The customer must be 21 years to 65 years.

- One should be earning Rs. 25,000.

ICICI Bank Home Loan Application Status

Required details

ICICI home loan applicants can enjoy various features such as low-interest rates, payment periods, process duration, and application facilities. However, the applicant requires some details to check their application status, such as:

- PAN number

- Date of birth

- Reference number

- Form number

- Name of applicant

ICICI Home Loan Application Status

The ICICI bank website page is open to all bank customers to help avail any banking service. The home loan applicant can also check the status of the application through the official website.

ICICI Home loan status check using ICICI website page

Open the ICICI BANK website page

https://www.icicibank.com/

On the homepage

The menu selects the option “Products” >”Home loans” from the tab “loans.”

Select the “Know more” option on the Home loan page

Proceed to the “Know your loan application status” page.

Next, enter

Your “application number” and “registered mobile number.”

Review the details on the page

Ensure they match your bank account records.

Next, click the tab “Send OTP” tab

The system will send the OTP code to your mobile number

Enter your OTP code and click submit button

The page will show the ICICI Home loan application status on the screen.

ICICI Home Loan Status Check Using Mobile APP

ICICI mobile app is a simple feature available on a user’s mobile device. The application allows the customer to access all banking services through mobile. ICICI bank mobile app is referred to iMobile pay app. It’s available in all operating systems making it easy to download and launch.

- First, download the iMobile app and open it on your smartphone.

- Next, register and activate to acquire the login details.

- Once open, proceed to “create new account” follow the page instructions to complete the process.Here the user will create a login PIN or use a fingerprint as a login credential.

- For existing users, click the tab “I already have an account” to proceed.

- On the page, select “Cards, Loans and Forex” under the tab asking “What would like to do today?”

- Now, click “loan account” under the list of all ICICI Bank accounts on the page.

- Choose your preferred bank account for which you’re applying for the Home Loan.

- Next, go to the tab “Track New Loan” and key in the following details:

- Mode of application

- Application number

- Name

- Date of birth

- If interested in a cashback offer.

- Recheck the information and verify for any corrections.

- If okay, click the “submit” option.

- The application status will be displayed on the screen.

ICICI Bank Home Loan Status Check via Offline Method

A customer may prefer the offline application status check method. The bank provides customer care contact numbers to help customers call directly or use the IVR facility.

- Open the ICICI website link

- https://www.icicibank.com/

- click the “contact us” button under the option “Get in Touch.”

- The system will show all ICICI customer care numbers.

- Select the persona banking number 1860 120 7777. The number is available to all Indian cities and towns.

- Call the number to speak to the Bank executives and request your Home loan application status.

- Note all customer care numbers indicated on the page work and are open to all customers.

FAQs

What are the charges for the customer care contact numbers?

The charges may only apply based on the telecommunication provider service. This means the charges are different based on your provider.

What makes ICICI home loan easy and the best service for customers?

The payment plans are very flexible (up to 30 years) and suit many customers. The bank has low-interest rates. ICICI Home loans are categorized in different schemes to suit all applicants. The bank offers the services to all genders aged from 21 to 65 years without discrimination if they fulfill the requirements.