Current HDFC FD interest rates: HDFC FD interest calculator 2023. HDFC Bank FD Interest Rates 2023 at https://www.hdfcbank.com/personal/resources/rates

HDFC FD Interest Rates

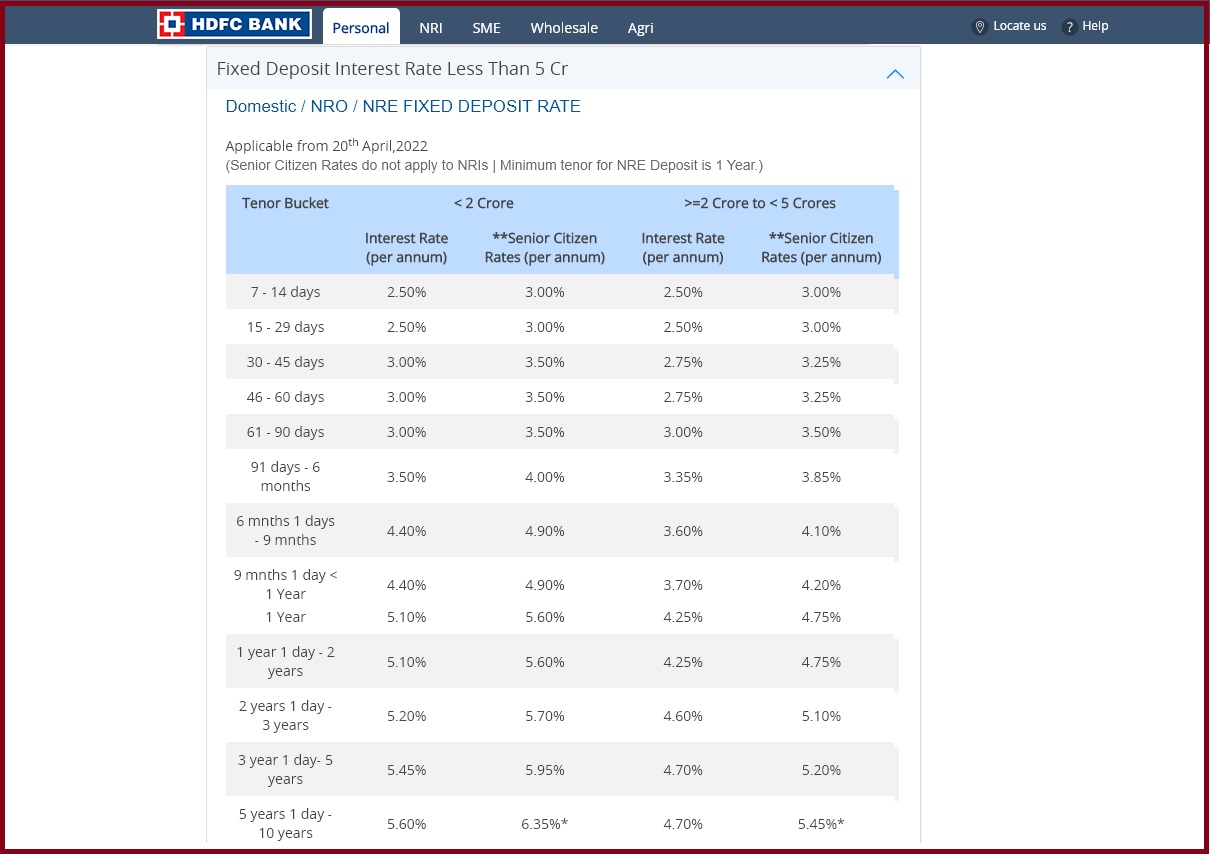

The HDFC Bank customers can invest in long-term and risk-free facilities for better returns in the future. The bank offers various types of HDFC FD (fixed deposit) accounts to allow customers to save based on their abilities. HDFC FD bank provides a deposit tenure of 7 days to 10 years. The FD accounts offer interest per the bank’s policies.

The returns are gained on maturity, giving the account holder a reasonable amount. The interest rate is earned in different monthly, quarterly, or yearly phases. HDFC bank provides an additional 0.5% interest for senior citizens saving through HDFC FD accounts.

Types of HDFC Fixed Deposit schemes

- Regular fixed deposit

- Overdraft against FD

- FCNR fixed deposit

- 5-years Tax Saving FD

Eligibility Criteria for HDFC Bank FD Account

- Indian residents

- Any member of the Hindu Undivided Family

- A firm with a sole proprietorship

- Firms with partnership status

- Trusts

- Limited companies

HDFC FD Online Calculator

HDFC online calculator is a digital tool designed by the bank to help FD account users to calculate their maturity amount. The FD account user can determine the amount they will receive after maturity and the interest rate the bank is using for FD accounts.

Details on the HDFC Online Calculator

The calculator contains information such as:

- FD investment amount

- Tenure or period

- The applicable HDFC rates

- Frequency of interest rate calculation

Importance of HDFC Online Calculator

- The calculator allows the user to determine the maturity amount for a specific saving duration. This helps the account user to select the account type before investing.

- After determining the maturity amount, it’s easy to decide on the deposit tenure.

- The online calculator offers more accurate details compared to the manual process.

- The HDFC online calculator helps the user to have a better financial plan.

HDFC FD Interest Rates

How to Use HDFC FD Online Calculator

The HDFC Bank has set a particular formula to help FD accounts get their correct maturity amount for the FD. To arrive at the amount, the user must provide the following details:

- FD amount

- Tenure

- Interest rate

- Interest rate frequency

Formula

A= P (1+r/n) ^n*t

The abbreviation means:

- “A” is the maturity amount in the FD

- “P” is the principal amount or the amount you have invested in the FD

- “R” is the HDFC interest rates

- “N” represents the number of times the interest rates are calculated. Note “n” is equal to “1” if the user calculates annually. “2” for half-yearly and “4” for quarter yearly.

- “T” this the period of tenure for the fixed deposit.

How to Check HDFC FD Interest Rates for 2023 Through AN Online Calculator

Step by step to Check HDFC FD Interest Rates for 2023 Through AN Online Calculator

- Open the HDFC online calculator website page.

- Select the “senior citizen” category (Yes or No). Applicants above age 60 are ranked under senior citizens; others select the general category to proceed.

- Enter the type of HDFC FD account (reinvestment, quarterly payout, monthly, etc.)

- Next, key in the deposit term in months and days and select the “next” button.

- Enter the date and amount of deposit.

- The system will display the HDFC interest rate according to the amount and duration provided.

- Select the “calculate” tab to open the interest rate table on the screen.

- The table shows the date-wise interest rate and the maturity amount.

Link: https://www.hdfcbank.com/personal/tools-and-calculators/fd-fixed-deposit-calculator

How to Get HDFC Interest Based on Duration

- Go to the HDFC Bank interest rate page.

- https://www.hdfcbank.com/personal/resources/rates

- The page will show the dates from 7-14 days, 1 year to 2 years, and more. The duration will also have the interest rates earned.

- HDFC bank has a separate category for senior citizens. They have the privilege of extra interest rates on their maturity amount.

FAQ’s

What is HDFC’s maximum FD investment amount?

The HDFC FD account doesn’t limit the user on maximum saving. One can save as much as they want on their account.

How much money is required to open an HDFC FD account?

The bank requires the account user to deposit Rs. 5000 to open an FD account.

Is it possible to change the maturity period for any ongoing FD account?

The HDFC bank doesn’t allow the user to change the maturity period for an active FD account.