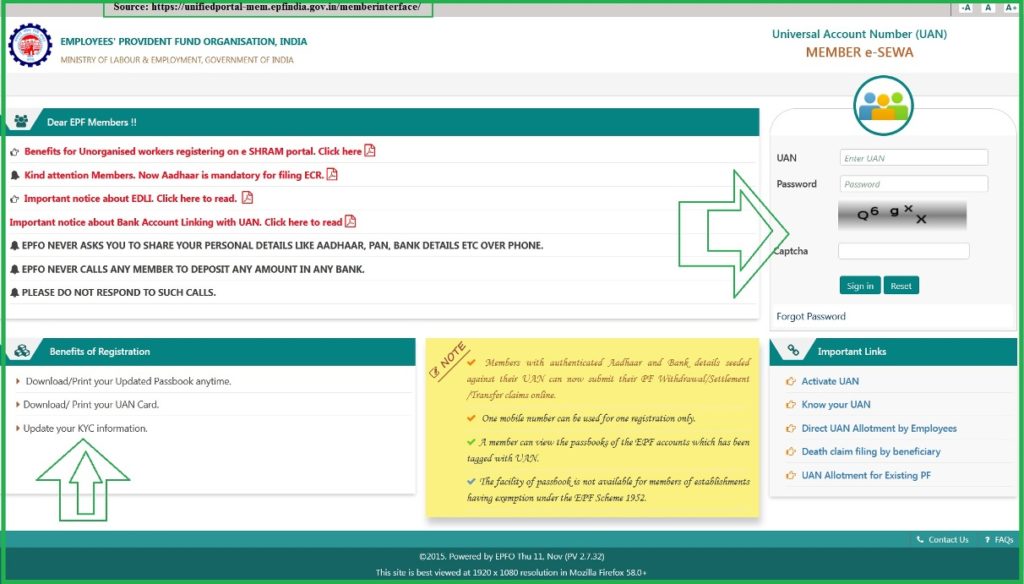

How to Transfer EPF Amount Online. How to Transfer PF Amount to Bank Account at https://unifiedportal-mem.epfindia.gov.in/memberinterface/

PF Transfer Online

The provident Fund (PF) is a retirement relief for all registered employees under the EPFO. Private and public organizations can register their workers under the EPFO body for PF benefits. The funds are directed to help applicants during retirement age. The employer and employee contributed towards the PF account every month. The Indian government requires all Companies with 20 (more or less) employees to register under the Employee Provident Fund Organization.

The organization offers the employees a PF account where the contributions are pooled every month. The employee has the privilege to access the account for regular checkups. The retirement scheme doesn’t limit employees to one employer or organization. Today employees can merge all their PF accounts under on account using UAN.

Unifiedportal-mem.epfindia.gov.in/memberinterface/

What is UAN?

In the past, employees had multiple PF accounts from all the companies they worked. It was challenging to merge all the amount after quitting a job making employees lose their savings. However, the EPFO developed a unique identifier, namely UAN. The Universal Account Number is a 12-digit identifier unique to all employees. The number is used to merge all the PF accounts under one platform.

Registered employees should request the UAN number and activate it to access PF services. The UAN helps the user to transfer funds from one account to another. It also allows users to view requests for partial PF withdrawals, PF claims and more. Every member should hold a UAN number to utilize all EPFO services efficiently.

About PF Transfer

If employees wish to switch jobs, they can withdraw funds from the old PF account and transfer them to the new PF account. The employee can also transfer funds from all other PF accounts in previous jobs before introducing UAN and merging under the UAN.Any dormant or closed account within the five years of the opening is taxable based on the income tax law.It’s advisable to shift all the PF funds to your new account to evade the tax imposed.

Eligibility Criteria for EPF Transfer

- An activated UAN

- Active mobile number

- Bank details such as IFSC code, bank account, etc.

- Aadhaar card linked with UAN

- Date of joining and date of exit

- Reasons for exit

- Identity proof documents: PAN card, Aadhaar card, DL, etc.

- The revised Form 13

- UAN number

- Old and new PF accounts.

- PF transfer form

How to Transfer PF Online

Step by Step Process to Transfer PF Online. Transfer EPF Amount online through EPFO UAN Portal.

Visit the UAN website page via the link

Direct link: https://unifiedportal-mem.epfindia.gov.in/

Proceed to the login page and enter your UAN and password details

Next, enter the captcha code select the “login” button and access the page.

Select the ” online services” tab

IF your smartphone doesn’t show the options click the “desktop site” option.

Proceed “one member one EPF account” button to continue

A new page will show. Displaying user’s details and UAN account details.

Review the details and make any changes if required.

Click the “present employer” option under the previous employer sections.

Now, enter your Old UAN number

> get details > old PF account number > employers name options.

Employees without the old details

should click “Get MID” and enter the EPF number.

The system will show the previous PF account and other account details

Now, choose the account your wish to transfer funds to the new PF account.

Select the “Get OTP” tab to receive the OTP on your registered mobile number

Enter the OTP to verify the details and click submit to complete the process.

How to Track PF Transfer Status Online

- Open the UAN website page.

- https://unifiedportal-mem.epfindia.gov.in/

- Select “track claim status” options.

- Next, select “transfer claim status” to view the PF transfer details.

FAQ’s

How to Transfer PF Online at EPFO Uan Portal link

Direct link: https://unifiedportal-mem.epfindia.gov.in/

Can EPF be taxable?

Yes, if an employee withdraws EPF before five years of continuous employment.

What is UAN Number?

The Universal Account Number is unique provided by the EPFO to every registered EPF member. The number helps the user link all the PF accounts under one single platform.

For more information about How to Transfer PF Online & Track epf amount status online visit this link https://unifiedportal-mem.epfindia.gov.in/memberinterface/