A Guideline on IndusInd Bank Account Zero Balance Savings Account. IndusInd Bank Zero Balance Account Opening Online. 2025 Indusind bank account opening zero balance.

Indusind Bank Zero Balance Account

Saving money reduces financial strains and provides freedom that allows users to transact any amount. Most Indian banks and financial institutions encourage people to create saving accounts from their favourite bank. This helps in money management and safety.

Various bank accounts offer great benefits such as interest, cash back, discounts, and more. A zero-balance saving account is a popular and sought-after account with various benefits. It’s a deposit account that doesn’t require any maintenance fee.

IndusInd Bank

The IndusInd Bank is a financial provider in India headquartered in Mumbai with the right solutions for its customers. It is among the first private banks invented in India, offering transactional, commercial, and electronic banking services and products. It was set in motion in April 1994 by the Union Finance Minister, Manmohan Singh. IndusInd Bank is among the top banks in India, with more than 2000 branches and 5000 distribution centres across the country. The bank has a quality range of services, including credit cards, loans, deposits, and debit cards.

Benefits of Saving Account

- Eases the withdrawal and deposit processes

- Nominal interest is earned from excess cash

- Facilitates savings and eases access to funds

Limitations of Saving Accounts

- Its high liquidity leads to spending a higher amount

- Has low-interest rates

IndusInd Bank Zero Balance Account Opening

Eligibility Criteria of Indus Online Savings Account

People eligible to open the Indus Online savings account include the following;

- Indian citizens

- People residing in India

- Aadhaar card holder

- People aged 18 years and above

- PAN holder

Document Needed to Open a Savings Account in Induslnd Bank

- NREGA Card

- Passport

- PAN Card

- Driving Licenses

- Voter’s Identity Card

- Aadhaar card

- Letters containing details of name and address issued by the national population register

IndusInd Bank Zero Balance Account Opening Online 2025

The process of Opening an Indus Savings Account, Follow the mentioned steps below to open an Indus Saving Account

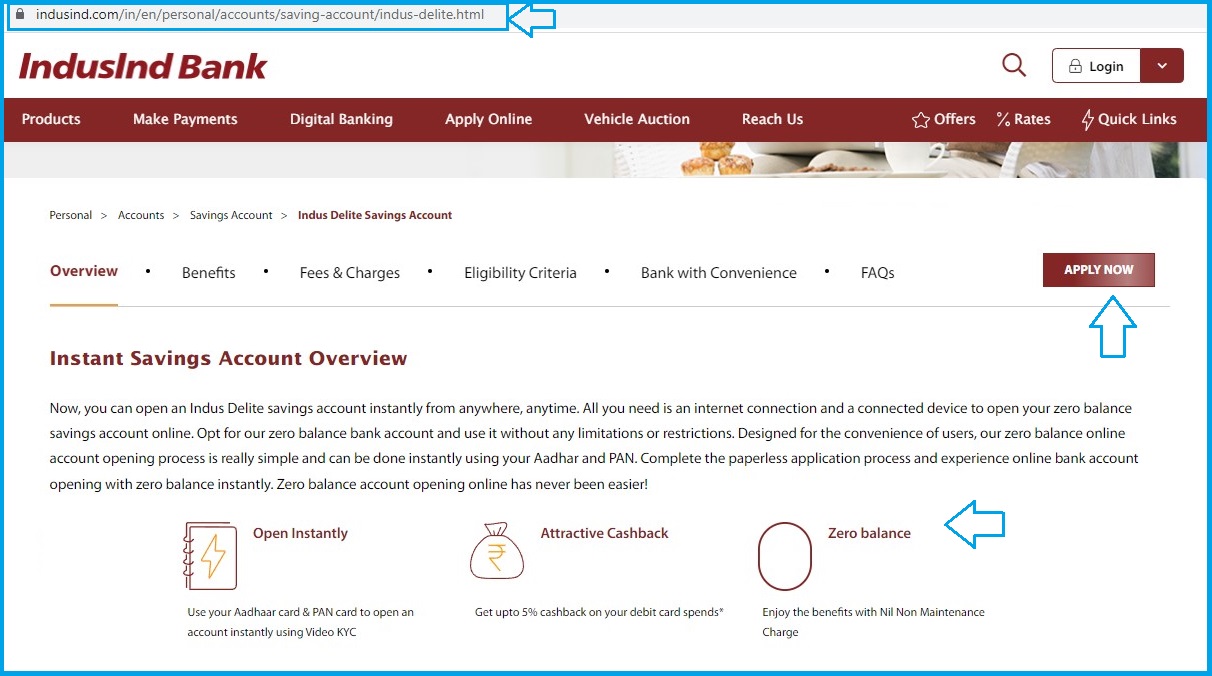

- Visit the IndusInd Bank webpage link and proceed to the online savings account section at

- https://www.indusind.com/in/en/personal/accounts/saving-account/indus-delite.html

- Press the Click Here or Apply Now button to begin the account opening process

- Continue by selecting the Open your account button

- Input your mobile number to create your Account

- Write down the OTP sent to your mobile phone

- Fill in your nearest city and location to be allotted a Bank branch

- Write down your Aadhaar number and PAN, then accept the terms and conditions provided and press the Send Verification Code

- Key in the OTP on the same page and press the continue button

- Input your details and other required details

- Next, note down your nominee’s details

- Select your desired Indus Online savings zero balance account

- Key in your mobile banking details like username, and include your UPI id address

- Verify your details and press continue

- Finally, fund your Account or pay for the debit card

Indusind Bank Savings Account Opening Offline (At Branch)

The procedure to open IndusInd Bank saving Accounts Offline

The IndusInd bank allows its users to open an offline saving account in the following steps;

- Go to your allocated bank branch

- Answer all questions in the saving account application form and provide the needed documents.

- Give out your self-attested PAN and Aadhaar card to the officials

- Select the preferred savings account you would like to open

- Submit all your documents containing your proof of identity

- The bank verifies your details and opens your savings account

- You will now be given a welcome kit containing the necessary documents to help you operate the Account.

How Many IndusInd Bank Saving Accounts?

Types of IndusInd Bank Saving Accounts

The various types of saving accounts in IndusInd bank include;

- Indus Select saving Account

- Indus Exclusive Savings Account

- Indus Maxima Saving account

- IndusInd Privilege Active Savings Account

- Indus Diva Saving Account

- Indus Senior Citizen Savings Account

- Indus Progress saving Account

- Indus Younger saver account

- Indus partner saving Account

- Indus stox 3-in-1 account

- Indus Delite zero balance savings account

- Pioneer banking and wealth management

- Indus Multiplier Max Saving account

- Indus Classic Saving Account

- Indus small saving Account

Indus Select Saving Account

The Indus Select savings account has a hassle-free and pleasant banking experience that provides quality services and rewards. Its features include;

- The account holder gains a 50% discount during the first year

- Account holders get a complimentary lounge access

- A cross currency mark up of 1% is levied on the card

- Account holders are allowed to withdraw a daily cash limit of Rs.150000 and a POS Limit of Rs. 300000

Indus Exclusive Savings Account

This banking account contains good facilities, customer support, privileges, and offers, as mentioned below;

- Account holders get free platinum exclusive debit cards that last for a lifetime.

- One can review wealth transactions and provide notifications whenever required.

- Has a complimentary airport lounge access

- Account holders can withdraw unlimited amounts within India

- No cross currency mark-up is levied

Indus Maxima Saving Account

The Indus Maxima Saving account offers exclusive services, privileges, discounts, and the lifestyle of the account holder. This provides exclusive banking solutions and premium services for account holders’ financial requirements as below benefits;

- It has a monthly balance requirement of RS.25000

- The Account deals more with fashion, shopping, and travels

- Has a discount of 25%on locker facility during the 1st and 2nd year

- Provides complimentary insurances coverage with platinum plus debit card

IndusInd Privilege Active Savings Account

It is a convenient and rewarding banking experience with active payments and balance transfers. Other privileges and benefits include;

- Gives 25% off on locker rentals

- An Rs. 1.5 lakh complimentary insurances cover is offered by Visa Gold Debit card

- With an ATM limit of Rs. 50000 and a POS limit of Rs.100000, a Titanium debit card is issued.

Indus Diva Saving Account

This banking account is crafted for women to encourage them to open savings accounts. It offers the best savings solutions and privileges mentioned below;

- Levies a 2% currency mark-up

- Gifts a welcome voucher of Rs.1000 to women involved

- Issues a platinum plus debit card containing a daily withdrawal limit of Rs.125000 and a POS limit of Rs.200000

Indus Senior Citizen Savings Account

Indus senior citizen savings account is crafted for seniors to promote efficiency in banking during their old age. It contains higher returns and benefits like;

- An account holder is given a Visa Platinum debit card

- Offers doorstep banking facility

- Account holders are allowed to choose their preferred account numbers

- Provides a fingerprints authentication facility in case the account holder forgets the password

- Provides up to 2 free zero–balance accounts for family members

Points to Note While Opening IndusInd Bank Zero Balance Account

- Check if the number of withdrawals from ATMs is charged or free. If free, check to what extent

- Check if the NEFT/IMPS/RTGS transactions are charged or free

- Ensure your Account maintains an average account balance to avoid paying a penalty.

- Check whether the debit card charges are high or satisfactory

Guide on ICICI Bank Insta Save Account Opening Online

FAQ’s

What are the needed documents required to open a savings account?

Documents needed to open a savings account are an NREGA Card, Passport, PAN Card, Driving License, Voter’s Identity Card, Aadhaar card, and Letters containing details of name and address issued by the national population register.