Online EPF withdrawal using UAN: Steps on PF withdrawal online. How to Withdraw EPF Amount Online | PF Claim Status 2022. UAN Activation and Acquisition at www.epfindia.gov.in

EPF Withdrawal

The EPFO provides the privilege of withdrawing the Provident Funds without any restrictions. Registered employees under the EPF scheme can withdraw their funds partially or entirely, depending on the situation. This allows employees to find purpose in saving for their retirement. EPF scheme is a compulsory scheme initiated by the Indian government and managed by the EPFO.

The scheme is design to help employees from both public, and private sectors save for their retirement. The EPF scheme saving amount is derived for the monthly salary and employer’s contribution. The money is pooled together by the EPFO to benefit employees at their retirement age. However, the scheme is open to exceptional cases such as marriage, education, medical, building or buying a home, and more. The partial withdrawal is different based on the employee’s claim.

PF Withdrawal

To withdraw, the user should avail their UAN to first processing. The UAN (Universal Account Number) is also a mandatory and legal number issued to all employees registered under the EPFO. UAN helps merge all PF accounts under one account. Employees don’t have to operate multiple PF or loss their money when they change jobs. The UAN is unique and personal for every employee.

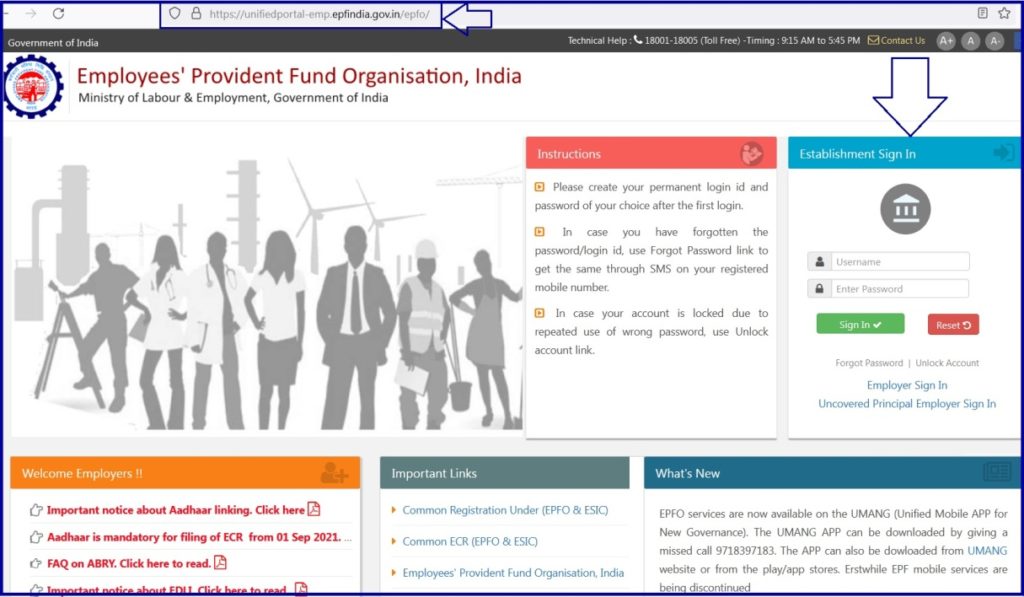

Unifiedportal-emp.epfindia.gov.in/epfo/

UAN Activation and Acquisition

The UAN number can be obtained through your Employer or EPFO/UAN online portal. The majority of organizations print the UAN on the payslip to ensure employees get it directly.

Through EPFO UAN Portal

- Open the UAN website portal via the link

- https://unifiedportal-emp.epfindia.gov.in/epfo/.

- Next, click “Know your UAN” to proceed to a new page.

- Key in your registered mobile number and enter the security code.

- Proceed and click “Request OTP,” enter the code for verification to continue.

- Next, enter the following options: Date of birth, PAN/ Aadhaar number/member ID, and captcha code for authentication.

- Now select “show my UAN.”

- The system will send a PIN to the registered mobile number.

- Enter the pin and click “validate OTP” >click the “UAN” button.

- The UAN will be sent to your mobile number via SMS.

Activation

- Go to the EPFO INDIA website page.

- https://www.epfindia.gov.in/site_en/index.php

- On the menu, proceed to the “services” section and select the option “for employees.”

- Next, select “member UAN/ online services” to open the UAN page.

- Select the option “activate UAN”>enter your UAN number / member ID / Aadhaar number, name, date of birth, registered mobile number, and email ID.

- Recheck the details and enter the captcha code to proceed.

- Now select “Get Authorisation PIN” the portal will send a PIN to your registered mobile number.

- Click the “I agree” tab on the checkbox and key on the OTP code sent to your mobile number.

- Select validate OTP and activate UAN.

- The system will send a password to your registered mobile number to help you access your account.

PF Withdrawal Online Process

How to withdraw PF online using UAN : After acquiring and activating your UAN, you can easily withdraw PF funds using UAN on your device.

Go to the EPF website portal via the link

https://unifiedportal-mem.epfindia.gov.in/

Enter your password and UAN number to log in to your account

On the menu, click the “online services” >” claim” option

Next, enter your “Bank account number” and select the “verify” button

The page will pop up a message for you to “accept” the page’s terms and conditions.

Click the “YES” button > “proceed for online claim” tab

A new page will open click “withdraw type” For example, advance claim, or form 19/ 10C and 10D for employees who are unemployed for more than 90 days.

Enter the PF account you wish to withdraw funds from

Now enter your preferred amount and provide a reason for withdrawing the amount

Enter your address and upload your passbook or cheque photo

Next, tick at the consent statement option to continue

Select the “Get Aadhaar OTP” tab to receive the code to your registered mobile number

Click the “verify” button to authenticate the details

The system will automatically send the withdrawal request to your employer and field officer

Give the employer time to review and approve the request.

How to Check EPF Claim status

- Open the EPFO UAN website page link.

- https://unifiedportal-mem.epfindia.gov.in/

- Login using your UAN number and password to access the page.

- Next select “online services” > “track claim status.”

- The page will provide the claim status with various options.

- The page might show “sent to field office” this means the request has been sent to the employer and field officer for approval.

- Also, one can receive “claim settled,” meaning the request is already approved and the amount sent to the bank account.

- The money may reflect in 3 to 4 working days.

Eligibility for PF Withdrawal

- To claim the total amount, the employee should attain the retirement age.

- The partial withdrawal request is for exceptional cases such as medical emergencies, building or purchasing a home, marriage, and education.

- Employees can get 90% of the PF amount one year before retirement age.

- If the worker is unemployed for more than 90 days, they can claim part of the PF amount.

- The EPFO allows for 75% of the PF amount if the employee is unemployed for one month.

- The remaining amount should be transferred to the new account once they are employed.

Required Documents for EPF Withdrawal Process

- A composite form

- Identity proof documents

- Address proof documents

- Revenue stamps (2)

- Applicant’s bank statement

- A canceled cheque or passbook. The bank details should be visible.

- Applicant’s identity details such as name, date of birth, father’s name, and more.

FAQs

What are the two types of PF withdrawal?

Partial withdrawal Full PF withdrawal

Can I withdraw my PF after I lose my job?

Yes, the EPFO allows for PF withdrawal if the employee is unemployed for 90 +days.However, you can withdraw the amount (75%) if unemployed for one month.

Can I withdraw the PF amount of the previous PF account from other jobs I have worked?

Yes, the UAN number helps employees consolidate all the PF accounts to one account. No money is lost since the UAN number unifies all the PF accounts.